Homeowners Insurance in and around Davenport

Protect what's important from the unanticipated.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help insure your home in case of tornado or fire, but it can also be beneficial in specific legal situations. If someone were to hold you financially accountable if they tripped in your home, the right homeowners insurance may be able to cover the cost.

Protect what's important from the unanticipated.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Davenport Choose State Farm

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Bryan LaBerge can be there whenever mishaps occur, to get you back in your routine. State Farm is there for you.

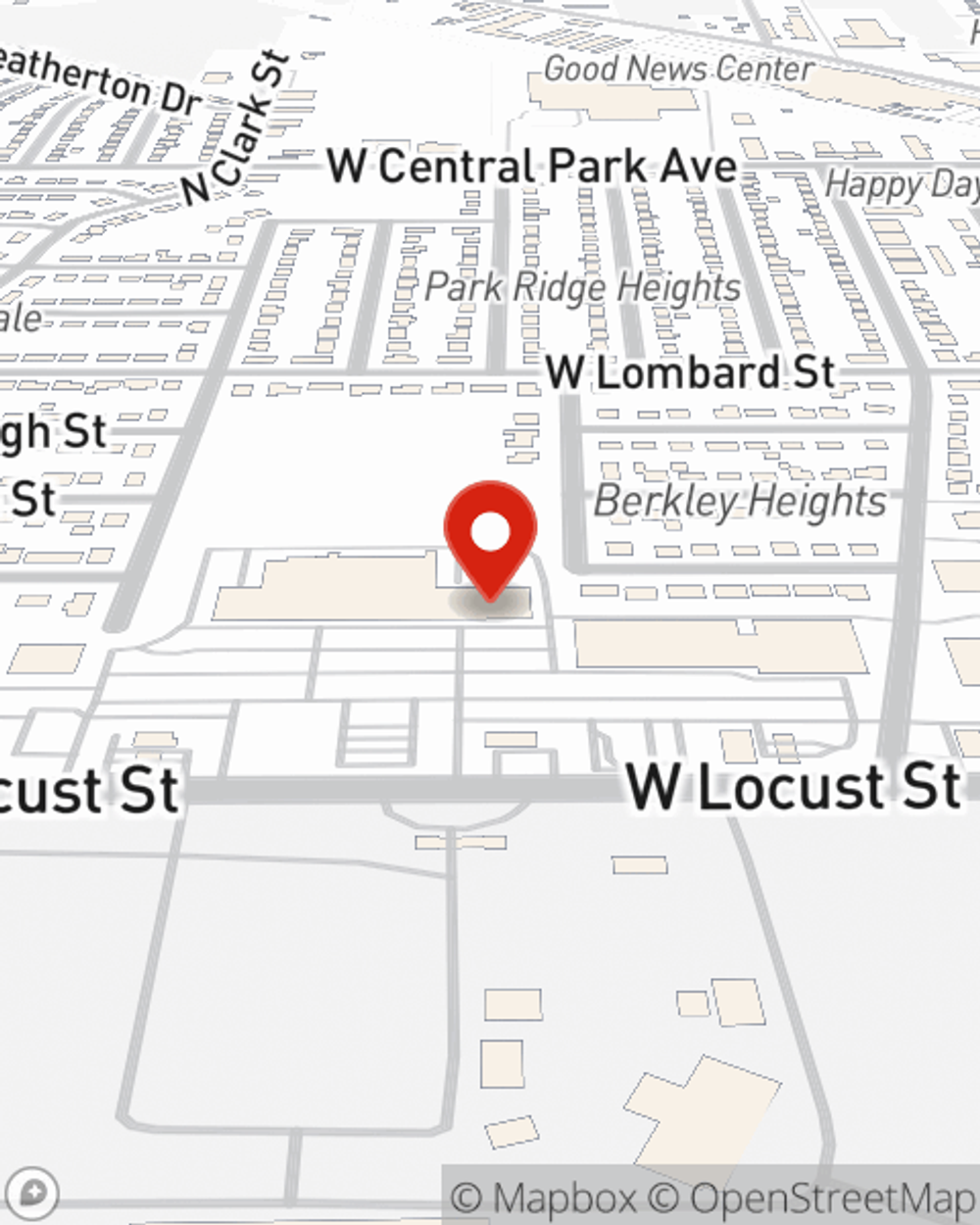

For great protection for your home and your belongings, check out the coverage options with State Farm. And if you're ready to get the ball rolling on a home insurance policy, stop by State Farm agent Bryan LaBerge's office today.

Have More Questions About Homeowners Insurance?

Call Bryan at (563) 386-2836 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Bryan LaBerge

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.